My Account

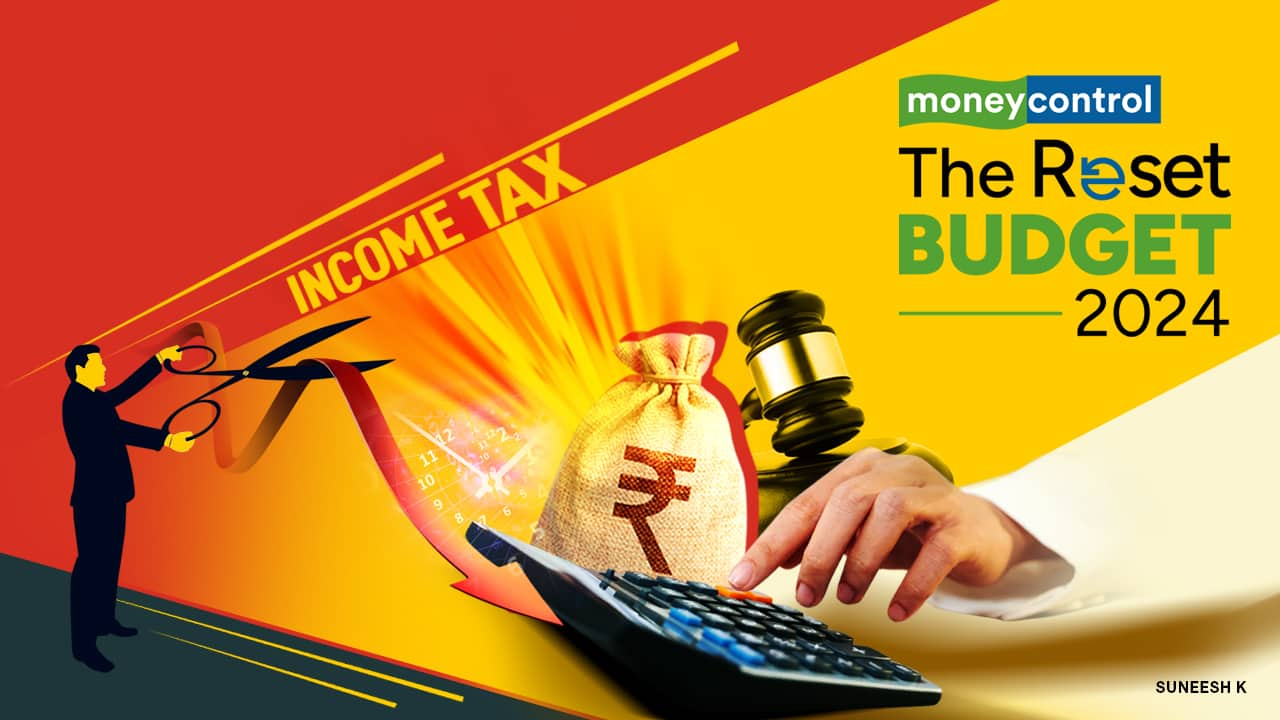

Economic Survey pegs growth at 6.5-7%, lauds stock market growth; all eyes on Budget 2024

Budget 2024

India Inc welcomes Budget focus on infra, consumption growth and employment

Budget 2024

Here are the key themes likely to be in focus post Budget

Sitharaman presented a budget with a mixed bag of announcements that many view as a balancing act between pleasant surprises and mild shocks.

Budget Trends

Old tax regime beneficial primarily for those with significantly higher tax deductions

Tax outgo will be lower in the old, with-exemption regime if you claim multiple, higher deductions; primarily, home loan interest or house rent allowance (HRA). For low-income earners and others with fewer deductions, the new, simplified regime will score.

Budget Takeaways

Sectoral Impact

| Company | Price | Change | %Gain |

|---|---|---|---|

| M&M | 2,974.90 | 83.55 | 2.89 |

| Titan Company | 3,186.25 | 65.40 | 2.10 |

| Tech Mahindra | 1,681.35 | 30.35 | 1.84 |

| Infosys | 1,829.95 | 26.90 | 1.49 |

| Nestle | 2,295.65 | 32.80 | 1.45 |

| Company | Price | Change | %Gain |

|---|---|---|---|

| Trent | 6,298.95 | -206.55 | -3.18 |

| Coal India | 424.05 | -11.30 | -2.60 |

| Asian Paints | 2,769.45 | -73.40 | -2.58 |

| Tata Steel | 147.57 | -3.38 | -2.24 |

| Shriram Finance | 3,007.95 | -62.20 | -2.03 |

Sectors in Spotlight

Identify sectors & stocks with budget impact

Play the FM

"Master the Budget: Play the Finance Minister and Shape the Nation's Future!"

Budget Word Cloud

Finance Minister's Priority Counter

State Of The Economy

Pitch Report

Budget Impact

Meet The Architects of Budget 2024

History of the Budget

Union Budget FAQs

Frequently Asked Questions

The Union Budget is an annual financial statement presented by the Government of India, outlining its expected revenue and expenditure for the upcoming fiscal year. It includes details on the government's plans for taxation, public spending, and financial policies to ensure the country's economic growth and stability.

INDIA BUDGET 2024

Union Budget 2024: Finance Minister Nirmala Sitharaman presented the first Union Budget of the Modi 3.0 government on July 23, signalling a shift in the political priorities under the new coalition era post Lok Sabha polls. The first full Budget of the NDA 3.0 government had rewards for the salaried class who have opted for the new tax regime with FM Sitharaman raising the standard deduction and tweaking the tax slabs. However, the Budget was a little tough on investors since the government announced an increase in the long and short term capital gains tax. Meanwhile, the RBI's dividend bonanza of Rs 2.11 lakh crore to the government helped Sitharaman accomodate the wishlist of allies like Chandrababu Naidu's TDP and Nitish Kumar's JD(U) for their respective states of Andhra Pradesh and Bihar. Meanwhile. buoyed by improvement in revenue collection, the government lowered fiscal deficit target to 4.9 per cent for the current financial year as against 5.1 per cent estimated in February's interim Budget. Finance Minister Sitharaman, however, retained the fiscal deficit estimate at 4.5 per cent for 2025-26 as announced in February. The gross market borrowings was also revised downward to Rs 14.01 lakh crore from Rs 14.13 lakh crore estimated in February.

Here are the five big takeaways from Budget 2024

Focus on Jobs: The budget addresses job creation with direct-benefit transfers, paid internships, and skill development programs to meet the demand for 7.8 million non-farm sector jobs over the next seven years.

Rural and Agricultural Support: Increased agricultural spending to Rs 1.52 lakh crore and rural spending to Rs 2.66 lakh crore aim to regain support in rural areas, which is crucial for the BJP's electoral strategy.

Targeted Regional Development: Special emphasis has been given to Andhra Pradesh and Bihar with significant funding for infrastructure projects, multilateral assistance, and temple economy development to strengthen political support in these states.

Continued Infrastructure Investment: The government has maintained high capital expenditure at Rs 11.11 lakh crore to drive growth while reducing the fiscal deficit to 4.9%.

Scrapping of Angel Tax: Despite increased capital gains taxes to curb speculation, the government decided to abolish the angel tax with an aim to boost startup growth and invigorate the economy.